Table of contents

- Introduction:

- Problems with today's Governance System:

- Governance models implemented in past to solve above problems:

- Democracy:

- Futarchy:

- Understanding Futarchy with an example:

- Now, lets understand the above example with the idea of Futarchy:

- Benefits of Futarchy:

- Arguments Against Futarchy:

- Futarchy and DAO's

- What are DAO's?

- Meta-Dao:

Introduction:

Governance is extremely important not only, just in terms of fostering a sense of fairness and justice but in terms of real economic landscape. Governace server as backbone of nation, influencing our decisions and actions. The quality of Governance will decide whether are societies will rise or fall.

For example: Lets take the difference of livelihood between the average Somali and the average German. The average person in Somalia faces challenges like violence, lack of basic services like clean water and low income. While, an average person in german earns high income (approx 45,457 euros per year), have access to good schools and universites, and lives in safety without having to worry about terrorists capturing the town.

The main resaon for this difference of livelihood between Somalia and Germany, is the quality of the Governance both countries are having. Germnay has strong institutions that has strong property rights which means people feels secure owning land and businesses in Germany while on the other hand Somalia has weak property rights, so people people are less motivated to produce things because they fear losing their profits to violence or local militants.

Germany is democracy where political leaders must retain the support of public while Somalia is an anarchy where power is won by brute force.

Institutions plays crucial role in shaping the social outcomes and condition of different countries. nstitutions are the source of both Somalia’s challenges and Germany’s comparative abundance.

Problems with today's Governance System:

All the national government, big organziation, small organizations face with the challenges of governance and also aligning the actions of the members in the organizations/nations interest instead of the personal benefit.

Are you aware of Global Costs and benefits and Local Costs and benefits ? Maybe yes or Maybe not, let me tell you

Global Costs and benefits refer to effects that impacts organization/instituion as a whole. The best scenario is when people take actions if, and only if, they predict that the action’s global benefits will outweigh the action’s global costs. But with humans this not always the case as even the greatest of every individual have some greed in them which will force individuals to take actions based on a ‘greedy’ or ‘irrational’ algorithm that focuses on local costs and benefits or conformity with peer groups.

So, local costs and benefits refers to effects that impacts individual. Generally, most of the humans takes actions only and only if they will benefit from it.

Many governance systems also face the issue of low-information voters. This problem arises when voters lack sufficient information about political issues, candidates, and government policies. In the past, there have been instances where a majority of voters were not even aware of their political representatives.

According to many experts, governments often opt for inferior policies even when superior alternatives are available, under the belief that these alternatives could benefit others.

There is lack of sufficient incentives for individuals or businesses to invest time and resources in creating or maintaining public goods. Public goods are goods that are available to everyone such as public parks, street lighting, clear air etc. Individuals and businesses typically invests in places where they get private beenfits or profits. Public goods however do not provide direct financial returns to those who invest in them because they are freely available to all members of society.

Although corporations are generally painted as rational and profit-maximizing, but research shows that boards of directors and managers often have very different incentives than their shareholders.

This problem is even more severe in DAOs. There are projects that sells DAO tooling but fails to implement DAO structure themselves, there have been instances where project teams makes misuse of funds from DAO treasury for there personal gain and since many people dont know how to use blockchain applications low participation in governance is also seen.

Governance models implemented in past to solve above problems:

Philosopher Kingdoms: Plato didn't trust that ordinary people will be able to make good decisions as he thought they are not smart enough. Instead he belived that a small group of smart and unselfish leaders known as Philosopher Kings should have the power to make decisions that will benefit everyone, with no self interest involved.

- Since, Philosopher Kings are both wise and smart, we can rely on them to understand the effects of their actions and choose what's best for everyone.Instead of letting greedy or unintelligent people make decisions, the philosopher-kings should decide everything for the group. For example: These Philosipher Kings will assign the work and duties such as farming,building etc to individuals members.

Although Plato's vision of Philosipher Kings wasn't full implemented but some organization's have gotten close. Examples include the Catholic Church during Medieval Europe and present-day Singapore and China.

So what is the problem with this approach:

People like philosopher kings doesn't exist and even if they do I dont think they will want to be a philosipher king.

Another problem is that putting to much power in the hand of single person is not a good idea even if that person is exteremly wise and intelligent.

Aligining Incentives: The idea is here that centralize the power in a group of administrators, like phislosopher kings and make these administrators especially top ones ,answerable to the wider group.

- For example: Shareholders of a public company elect boards of directors and indirectly CEOs. Similarly, citizens in a democracy vote for presidents and/or legislative representatives. Most of the modern world is being operated by the democracy only.

Democracy:

We know mostly all of the countries today are following democracy as there governance. The most practiced type of democray are Direct Democracy, Representative Democracy, or a hybrid of the two.

In direct democracy the citizens are having the full control and they are directly involved in the decision making of the state.

A Representative democracy is the type of democracy where people elect representatives to make decision on the behalf of citizens.

But Democracy also has its flaws such as:

"tyranny of the majority": In a democracy decisions are made through voting, where the perferences of majority determines the outcome. This represents that the government represents the will of majority people, but it can also lead to mistreatment of of minority groups if their interests conflict with those of the majority. Example: If there is a policy that is supported by majority of the voters as it benefits them, but harms the minority groups, then minority groups will face discrimination or oppresion.

Generally, people opinions and preferences seem to have very little influence on public policy decisions in any country. Researchers such as Martin Gilens and Benjamin Page found that when it comes to making laws or policies, what most regular people want doesn't seem to matter much. Instead, it's the opinions and interests of wealthy elites and powerful interest groups that have a much bigger impact on what policies are put in place. So, despite living in a democracy where everyones voice is supposed to count it seems that the average person's voice might not carry as much weight as one might expect.

Now, all these approaches were having its own benefits and flaws, the emergence of innovative methods such as Futarchy presents an opportunity for reimagining governance systems.

Futarchy:

As a way to solve the above problems or to implement a governance system that is better than today's Robin Hanson proposed a governance mechanism known as Futarchy, followed by the slogan: "vote values, but bet beliefs".

Futarchy is a type of governance where instead of letting elected officials or public vote on decisions we let the markets decide.

Instead of directly voting on specific policies on whether or not to implement them, people would vote on a metric to measure how well their country, charity, or company is performing.

Then prediciton markets are created, that would be used to choose the policy that are most likely to improve the metric. So, this would work like this when a proposal is made, two prediction markets will be created, one for the acceptance of the proposal and other for the rejection of the proposal and each market will have its own asset.

People can then buy and sell assets based on whether they think the proposal will be accepted or rejected.

Now, the market is allowed to run for some time lets say 5 days and then at the end the policy with the higher average token price is chosen.

If the proposal is accepted, then all trades on the rejection market would be reverted, but on the acceptance market after some time everyone would be paid some amount per token based on the futarchy's chosen success metric, and vice versa if the proposal is rejected

Understanding Futarchy with an example:

Suppose, there is CEO of a company Xcorp. This CEO is considered worst CEO of his time by all of the Investors and they think if this CEO leaves the company it would proove beneficial for the company but the CEO is not fired because the board of directors want him there. It could be the case that it wasn't in companies interst to keep the CEO, but board of directors allowed him to stay for personal benefits or something else.

Now, lets understand the above example with the idea of Futarchy:

Firstly, instead of board of directors making the decision to fire or retain the CEO. Now, what will happen is a metric is decided such as how will it affect companies share if the company fires the CEO or retains the CEO.

Now, two markets will be create on market is for retaining the CEO and other market is for firing the CEO. And each market will have its own assets which means the Xcorp stock is divided into two parts.

So, you would be having one fire CEO stock and other retain CEO stock. Now, the market is allowed to run for some time lets say 5 days.

The corporation would look at the prices of both the stock and if the market value of the Xcorp is more if the CEO is fired, then it fires the CEO and if the market value of the Xcorp is more if the CEO is retainded then it retains the CEO and this how the futarchy works.

Benefits of Futarchy:

Firstly, futarchy takes away the problem of "voter apathy" and "rational irrationality"

Voter Apathy: This problem states that people are generally not intrested in voting or political processes as they might feel like their vote doesn't matter much so they dont bother to learn more about the policies or issues. In democracy, where majority decisions are made on through voting, voter apathy can lead to less informed decision-making and potentially harmful policies being implemented. In futarchy, if you have valuable information that is not avialable to everyone than you can profit from it. This creates a stronger incentive for people to become informed and actively participate in decision-making processes.

Rational Irrationality: This is a concept that suggests people act rationally in being irrational when it comes to gathering information or making decisions. Lets say it doesn;t make much sense for people to invest time and effort learning about complex political issues or policies because the likelihood that their vote will have a significant impact on the outcome is very low. For example: In a national election, the chance that one person's vote will sway the result is extremely small, estimated at 1 in 10 million. In Futarchy, by tying decision outcomes directly to financial incentives, futarchy encourages people to make rational decisions based on available information. Since individuals stand to gain or lose money based on the accuracy of their predictions, they are more likely to invest time and effort into understanding the issues and making well-informed choices.

Another benefit that Futarchy brings, is that markets give more power over time to those who are good predictors .This is because high returns both directly increase a trader’s capital and improve their ability to raise capital from investors.

Futarchy also reduces irratinal social influences such as in the past candidates height, personality or likability have influenced election outcomes. For example: There is the well-known story about voters picking George Bush because he was the president "they would rather have a beer with." In Futarchy,the governance process encourages people to focus on proposals rather than personalities.

Arguments Against Futarchy:

Some people oppose futarchy because they woory that powerfull individuals can manipluatet the market the way they want. If a powerfull entity wants a specific result they can keep buying "yes" tokens and selling "no" tokens to influence the market prices in their favor.

Another major concers about this governance model is that its based on Markets and Markets are volatile which means markets can be unpredictable and prone to sudden changes. This happens because markets are "self-referential which means that markets consists largely of people buying because they see others buying, and so they are not good aggregators of actual information.This makes markets susceptible to manipulation because manipulators can exploit this tendency for self-referential behavior.

The estimated effect of a single policy on a global metric is much smaller than the "noise" of uncertainty in what the value of the metric is going to be regardless of the policy being implemented, especially in the long term.

Another issuse is that human values are "Complex", and cannot be boiled down to a single metric or number easily.

A prediction market is zero-sum; hence, because participation has guaranteed nonzero communication costs, it is irrational to participate. Thus, participation will end up quite low, so there will not be enough market depth to allow experts and analysis firms to sufficiently profit from the process of gathering information.

Futarchy and DAO's

Now, Lets see how futarchy can be seen as a governance in a DAO, what benefits a DAO can get from implementing Futarchy.

What are DAO's?

A decentralized autonomous organization (DAO) is a type of governance that is found on blockchain that has no central governing body and whose members share a common goal to act in the best interest of the entity.

There is no central authority of a DAO; instead, power is distributed across tokenholders who collectively cast votes.All votes and activity through the DAO are posted on a blockchain, making all actions of users publicly viewable. DAOs rely heavily on smart contracts. These logically coded agreements dictate decision-making based on underlying activity on a blockchain. For example, based on the outcome of a decision, certain code may be implemented to increase the circulating supply, burn of a select amount of reserve tokens, or issue select rewards to existing tokenholders.

You would be asking: How do I engage in a DAO? How Do I participate? How do I help making decision? and you will find this is a bit tricky problem to solve. The easisest approach to this problem is that using an ERC20 token as Voting Power. But this solution is may not be optimal for all the DAO's as this is condiered as an unfair mechanism because users with most tokens have the most voting power.

There are siginificant issues with voting problem and most DAO's uses voting as there governance model. The actual decision in these DAO's are made by the people who are actually working for the DAO or core contributors/developers in these DAOs instead of token holders. Since, the core contributors are the ones who make the core decisions and so they are not really DAO's.

There have been instances where DAO teams have misused the project treasury for personal gains. Given that participants in DAOs are human and humans are often driven by greed, there is a risk of misuse of project funds for personal benefits. Therefore, a more robust form of governance is necessary.

Since, DAO' are based on blockchain and there are majority of people who dont known how use applications on blockchain, DAO's faces challenges such as low participation.

So, in this case futarchy can help since in this case instead individual making the decisions the markets will decide and since people trading on these markets can earn profit it will attract more user to participate.

The two main benefits that Futarchy brings in is that:

It makes it harder for the executives managing funds to cheat both organization and society for their short-term interest

Making governance radically open and transparent.

Meta-Dao:

The Meta-Dao is a DAO on solana blockchain that uses Futarchy to make its decisions. As discussed above in this article Futarchy was created by Robin Hanson in 2000 and has been discussed by many people such Vitalik Buterin, Ralph Merkle but no-one actually implemented Futarchy as a governance in any type of small/big organization, DAO but Meta DAO actually implemented it.

How the Meta-DAO implements futarchy

Meta Dao is composed of three open-source program from Solana Blockchain:

A Conditional Vault Program

TWAP Program

Autocrat Program

Now, lets understand all of the above concepts through a proposal:

All actions undertaken by any DAO are initiated and executed through improvement proposals, and this holds true for the Meta DAO as well. Anyone can create submit a proposal. So, anyone can interract with the Autocrat Program(Is an open-source program stored on the solana blockchain) and create a proposal.

That proposal contains attributes such as proposal number, proposal description link (contains description of the proposal) ,and an executable Solana Virtual Machine (SVM) instruction that can be excuted by autocrat program.

From the above screenshot you can see someone could create a proposal to transfer $150k in USDC. It appears to be a grant intended to fund a new product within the Meta DAO, or to enhance an existing product under the Meta DAO. It's possible that MetaDao is investing in a project in exchange for tokens, and the transaction could involve any activity that can be represented as an SVM instruction.

Whenever, a proposal is created autocrat programs makes sure that there are 2 markets specifically for that proposal a conditional pass market and a conditional fail market these are openbook V2 markets.

Both of these markets have TWAPs (Time weighted average price) oracles that autocrat can later fetch to figure out what the price is in the market.

Now, whenever a proposal is introduced and its finished, you would have people trade in these pass and fail markets. Users will be trading USDC for META token markets or atleast trade a little variance of both META and USDC.After the configurable amount of time (currently its 10 days),anyone can call the finalize proposal on autocrat and then autocrat checks both TWAPS.

Now, if the TWAP of the PASS market is greater than the TWAP of fail market then it executes the SVM instruction so in this case it would be transfer of 150k usdc to some account and after that it reverts the fail market and finalizes the pass market. So, now all the trades in the conditional pass markets are deemed valid while all the trades in the conditional fail market are reverted like they never happened. For example: So, if I bought 1 Meta for 10 USDC in the conditional fail market, that trade is reversed, and I receive my 10 USDC back. Similarly, the person who sold Meta to me gets back the original Meta they provided.

Conversely in the case, when the FAIL market is finalized the PASS market is reversed. So what that allow you to do is you cab speculate on how much meta would be worth if proposal were to pass or fail. For example: Lets say if the proposal passes the META's gonna be worth 20 USDC and I buy it in a PASS market for 20 USDC and lets say currently the price of META is 15 USDC. Then if the proposal fails I didn't need to loose 20 USDC, the trade will be reverted as fail market is finalized. So, in this case what I just did is wait for the trade to fall through. This benefits traders because if the anticipated action fails to occur, they can allow the trade to be reversed without suffering any losses.

Now, final thing that is important to discuss is how the trades get actually Reverted:

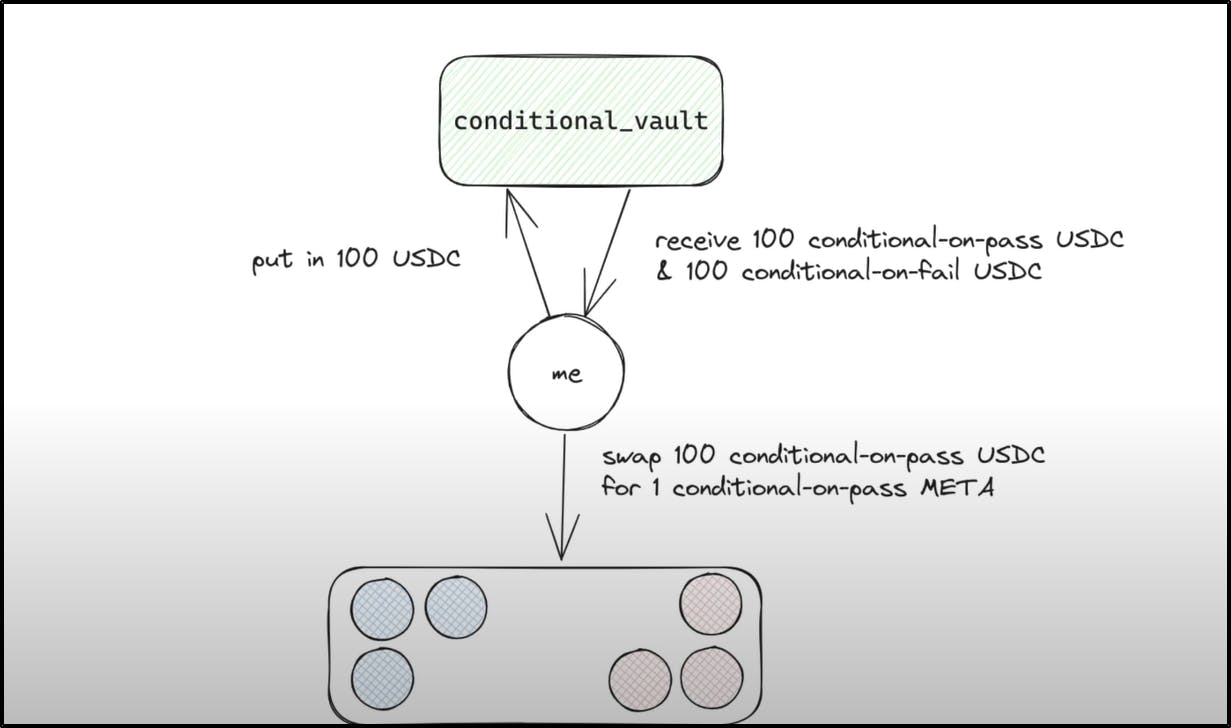

- Futarchy requires the ablility to ‘revert’ trades in a market so that everyone gets back their original tokens, but since all the transactions happens on the public blockchain so after the transactions have been finalized they cannot be reverted. So to solve this problem Meta-Dao came up with an intresting solution of conditional tokens. Before minting conditional tokens, someone needs to create a conditional vault. Conditional vaults are each tied to a specific underlying token and settlement authority. In our case, the underlying token would be either META or USDC, and the settlement authority would always be the Meta-DAO.

For each proposal Meta-Dao creates two vaults: one for USDC and one for META. This allows us to achieve the desired reverting of trades.

Anyone can come in and deposit underlying tokens such as Meta or USDC to a conditional vault and then the conditional vault will mint them two types of conditional tokens: conditional-on-pass tokens and the conditional-on-fail tokens and they recive an equal amount each corroponding to the amount they put in. For example: If I deposit $100 USDC into the conditional vault, then the conditional vault will give me back two types of conditional tokens for each market. So, I would be getting $100 pUSDC to use in pass market and $100 fUSDC to use in FAIL market.

Now, if the vault is finalized then the conditional-on-pass USDC can be redeemed for the original USDC that was put in and if its reverted then the conditional-on-fail USDC can be reedemed for the original USDC that was put in.

Finally, Lets see a Use-case:

Now, theres a proposal thats been created recently and after going through the proposal I think its good and can benefit the Meta-Dao.

So, I decided to put $100 USDC into the conditional vault and in exchange i will get $100 pUSDC token and $100 fUSDC token. Now, after getting these conditional tokens if I just hold them I will be able to redeem them for the $5 USDC that I put in.

So, lets say I decided to buy conditional pass meta using my $100 conditional pUSDC from the pass market and suppose someone is willing to sell there one conditional pass meta token (pMETA) to me for that price. Now, I am having $100 conditional fUSDC in the fail market and one conditional pass meta token (pMETA) in the Pass market.

Now, if the proposal passes I can redeem my conditional pass meta (pMETA) with real meta token and on the other hand if the proposal fails I will be able to claim back my original $100 USDC

Potential Drawback:

One of biggest drawbacks of markets is the Keynesian beauty contests. In many market scenorios especially in crypto markets, individuals often do not pruchase the assets what they think are best rather they purchase those assets because they think another person will buy after they have bought the asset leading to a price increase and so they like to frontrun the other person's irrationality.

- But when its come to voting its not a problem as when people vote they generally make their decisions based on their own beliefs and preferences rather than trying to predict or follow others' actions. I dont think people vote for some person/decision because they are thinking someone might frontrun them.

Using the Meta Dao APP:

To access the Meta Dao Interface:

You can access the Meta Dao Interface by visiting this url: "https://app.themetadao.org/"

After visiting the above URL you will get something like this:

- From the above screenshot you can see proposals that are currently active.

To connect your wallet with Meta-Dao Interface:

Click on the "Connect Wallet" button that you can see from the above screenshot and you will get something like this:

- Now, you can connect with wallet you use. In this case I am connecting to this application using my Phatom wallet.

After connecting your wallet you will see something like this:

- You will see you wallet address in the right-most corner.

Now, if you click on the "Wallet address" modal and you will see something like this:

You can see and make sure that you are connected on "Mainnet", if you click on the drop-down you can select other networks such as Localnet, Devnet and Custom.

Below the "Network" option, you can see the "Explorer" option by default we can see its using Solana.fm as Explorer but you can click on drop-down and choose from Solscan, X-Ray and Solana Explorer.

To Vote on a Proposal:

Select the proposal you want to vote on from the availabl proposals:

From the above screenshot you can see currently active proposals are Proposal 9 and Proposal 8

If you want see more information about any of the proposals you can click on the icon inside the red box in above screenshot and you will see all the information about the proposal there

Lets say I wanted to see more information about Proposal 9, so I will click on icon inside the red box in above screenshot or we can say the icon next to "See more" and new tab will open up and you will get something like this:

- Here, you find more information abou the proposal

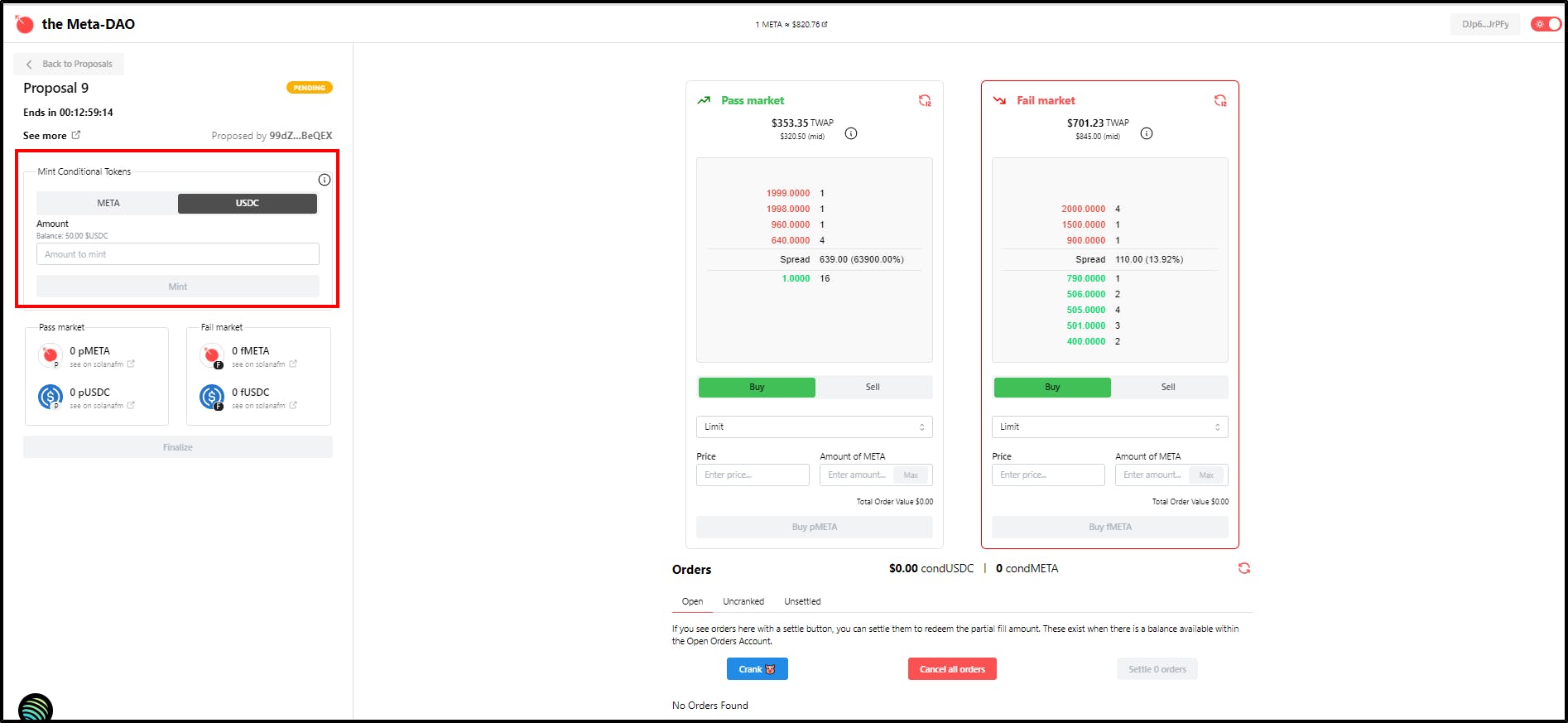

Now, go back to previous tab and click on the "Proposal 9" and you will see something like this:

Now, to start trading in the META/USDC conditional markets you need to mint conditional tokens. For minting conditional tokens, you need to attain either Meta or USDC token.

After, attaing either Meta or USDC or both token. Find the "Mint Conditional Tokens" section on the left side of the page, as highlighted in the above screenshot. In the "Amount" field enter the number of tokens you want to deposit and click on “Mint.” In this case for demonstration purposes I am deposting 5 USDC token:

Now, click on the "Mint 5 pUSDC and 5 fUSDC" button and you will be getting a prompt in you wallet for confirming the transaction:

- You can see in the wallet also that $5 worth of USDC is being subtracted from your wallet and two unknown tokens are being added and these unknown tokens are pUSDC and fUSDC

After clicking the "confirm" button you will be getting the pUSDC and fUSDC tokens as you can see in the below screenshot:

- Now, after minting the conditonal tokens at this point if you dont do anything with them just hold them you will be able to reedem your original $5 USDC when the proposal ends or you can start creating orders or start trading with your minted tokens in pass or fail markets.

To Redeem the tokens after the proposal ends:

Click on the redeem button, as shown in the below screenshot:

After, clicking on "Redeem" button you will be getting a confirmation from you wallet. So confirm the transaction:

After, clicking on "Confirm" you will get the original tokens back, since I deposited $5 USDC, I got this much amount back.

Conclusion:

Each governance system has it owns benefits and flaws. Futarchy presents a promising framework of governance that harnesses the predictive power of markets for decision making. Its implementation holds the potential to enhance efficiency, transparency, and adaptability, paving the way for more effective and responsive systems of governance in the future.

The Meta-DAO actaully implemented futarchy as a mechanism to make its decisions. The basic idea of futarchy is to give decision-making authority to markets. Since,this system is not human-led, it doesn’t suffer many of the problems of prior approaches to human organization.

References:

Meta-DAO Docs:

Meta DAO Youtube:

Futarchy Tutorial:https://www.youtube.com/watch?v=vqSmhQ_PUQg

The Story of Propsal3:https://www.youtube.com/watch?v=cqi8b9khAwc

How the Meta-DAO works: https://www.youtube.com/watch?v=AbhzbPy-nJc

The Human Alignment Problem:https://www.youtube.com/watch?v=zyDnD3NavZI

Building A World Free From Currencies | Prophet (MetaDAO)

Blog Posts: