Deep-Dive into Monaco Protocol

In this article we will be taking a deep-dive into Monaco Protocol which is built on Solana Blockchain.

What is a Prediction Market?

On a prediction market you can bet on whether a certain event will happen or not and you will be financially rewarded if you are correct. These events include stock price prediction, election results, sports game results, wheather forecasts etc

Imagine there's a prediciton market where people can buy and sell shares by prediciting wheather conditions. For example lets take "Will it rain tommorrow ?" as the event where users will be betting on.

So there will be two outcomes:

"Yes, it will rain" with share price as $0.20.

"No, it will not rain" with share price as $0.80.

So, what happens at the end?

If it rains shares for "Yes, it will rain" will be settled at $1.00, and the shares for "No, it will not rain" will be settled at $0.00. This means if you bought shares for "Yes, it will rain" at $0.20, you would receive $1.00 for each share you owned, resulting in a profit of $0.80 per share.

If it not rains "No, it will not rain" will be settled at $1.00, and the shares for "Yes, it will rain" at $0.00. This means if you bought shares for "No, it will not rain" at $0.80, you would receive $1.00 for each share you owned, resulting in a profit of $0.20 per share.

Prediciton markets use the betting trends and collective wisdom of participants to generate predicitons about future events,and individuals can profit by accurately predicting outcomes based on their analysis and information.

Monaco Protocol

The Monaco Protocol is a decentralized betting engine that offers global liquidity on prediction markets and it is deployed on Solana Blockchain. It is the key infrastructure needed to offer exchange-based and prediction-book applications, allowing operators to focus on incredible user experiences rather than paying for access to traditional black-box iGaming platforms.

Monaco protocol allows users to built exchanges on Solana by providing the infrastructure as programs are already deployed on the Solana blockchain that allows third party applications to build prediciton markets and access a shared liquidity pool.

Monaco Protocol also provides on-chain matching algorithm and orderbook that allows user to express an opinion. An opinion is something that you believe will happen (eg: will the proce of SOL will be above $100 by the end of month)

Users can submit an order to match it against best possible price available on the market

Orders are matched against opposite trades - with the protocol managing order matching, user market position and market liquidity pools.

What Monaco protocol offers ?

Global Liquidty: Applications using Monaco Protocol has access to global liquidity. So if any operator creates a market for the superbowl, anyone can use that market. If you're another operator you don't need to make your own superbowl market, you use that one. As such liquidity isn't fragmented. Now, operators can share liquidity not fight for fragments.

Fully non-custodial: This means that monaco protocol is fully decentrailzed and is not controlled by a single entity.

Single Outcome Binary Markets: Orders can be placed either "FOR" the outcome (it will happen) or to "AGAINST" it (it won't happen) at a specific price (odds) and stake (wager). Single outcome means there's only one event being predicted, simplifying the betting process.

Best-Price Matching: The protocol matches bets at the best available prices, ensuring that participants get the most favorable odds for their bets.

Partial Matching: Even if a bet can't be fully matched, the protocol allows partial matching, ensuring that participants can still place bets for the amount that can be matched.

Order Cancellation on Unmatched Amounts: If a bet doesn't find a match, the protocol allows for the cancellation of the unmatched portion, providing flexibility to participants.

Smart Risk Management: Unmatched risks (unmatched bets) can be used to fulfill new orders, optimizing the use of available funds and minimizing potential losses.

Inplay Betting with Betting Delay: This delay is implemented to allow customers to cancel unmatched orders on the system in response to changes in market conditions.

Settlement Straight to the Winning Wallet: Winnings are directly sent to the user's wallet, streamlining the payout process and reducing the need for intermediaries.

Sec3 Audits: Every release undergoes thorough audits by Sec3, ensuring the security and reliability of the protocol. These audits are made public on GitHub for transparency.

Ability to Charge Product Commission without Impacting Low-Fee Promises: The protocol allows operators to charge a commission without affecting the low fees promised to users, enabling sustainable business models.

Regular Improvements: The Monaco Protocol is committed to continuous enhancement, not only in the protocol itself but also in supporting tools and the overall ecosystem, ensuring ongoing improvement and adaptability.

How Monaco Protocol is different from its web2 and web3 peers?

Lets first talk about web2 peers:

Now, lets talk about how monaco protocol is different from its web2 peers:

Lack of Liquidity: Web2 betting applications have lack of liquidity because a single entity controls the liquidity pool, limiting its depth and reach. While Applications using Monaco protocol have access to Global Liquidity Pool which attracts more participants and capital, leading to tighter spreads and better prices.

High Fees: Commission charged by these apps are extremely high such as upto 40%. Applications built on monaco protocol charges very less commission. Let me explain this with an example: Betdex an application built using Monaco protocol charges three types of fees:

Protocol Commission: The Monaco Protocol may charge a commission on trades placed on the protocol. The commission rate is 1% as of October 24th, 2023.

Operator Commission: This commission is charged by the exchange on winning trades. This commission is charged as a % of net winnings in a given market. The commission rate is 2% as of October 24th, 2023.

Solana Transaction Fees: These fees are charged by the Solana blockchain and these fees are extremenly low

Lock Up Funds: Often problem with web2 betting application or predictive market application is that they lockup funds and asks to play for a certain number of times and only after that we can withdraw our money back. But Applications built using Monaco protocol take this away as the users can withdraw there money anytime without any restricitons.

Counterparty Risk or Fraud Risk: Some web2 betting applications are only launched to scam the user. First they create the hype and then make the users deposit the funds and then after having good amounts of fund on the platform they close the platform as such it never existed and run away with users money. The decentralized nature of the Monaco protocol mitigates these risks by eliminating the need for intermediaries which provides users with full control over there funds and providing a transparent and secure betting environment. Plus counter-party risk is eliminated thanks to funds being managed by fully-audited protocol.

Winners aren't welcome: In web2 betting platforms winning customers may face restricitons or are allowed to bet until a certain limit on there betting activites. Applications built on monaco protocol does not impose such restricitons on the user. The user can bet any amount he wants without any limitations.

Now, lets talk about how monaco protocol is different from its web3 peers:

Scalablity: When compared with exchanges with predicition markets built on Ethereum chain using protocol such as Augur, applications built on monaco protocol has siginifiant advantage. Since, monaco protocol is built on Solana blockchain it can take adavantage of solana's high TPS. Prediction markets typically involves larger number of participants making predicitons and placing bets on the outcomes. Since, it has been theoritically said that solana can handle 50,000 TPS the network can handle a significant volume of transactions simultaneously, allowing prediction markets to scale efficiently to accommodate a growing user base without experiencing congestion or delays unlike ethereum.

Lower Transactions Costs: We all known any transaction on blockchain requires fees and on Ethereum blockchain these fees are extremely high when the networks is congested and high when its not congested. So, when anyone is interacting with predicition markets on ethereum they will require to pay high fees when executing betting related transactions but since Monaco Protocol is built on Solana it can take advantage of its low fees. Since, solana provides High TPS which can results to lower transactions fees. Lower fees on interacting with prediciton market will make it more accessible to a wide range of users and encourage greater participation, enhancing liquidity and market efficiency.

Global Liqudity: Applications using Monaco Protocol has access to global liquidity. So if any operator creates a market for the superbowl, anyone can use that market. If you're another operator you don't need to make your own superbowl market, you use that one. As such liquidity isn't fragmented. Previously what was happening or still happening in other protocols is that Operator A will create a market for superbowl, Operator B will create a market for superbowl, Operator C will create a market for superbowl and soon you will be having 3 superbowl markets with different levels of liquidity. So in this case we see that the liquidity got divided into three parts so instead of using three separate markets for superbowl we can use only one and it will also helps in maintaining the liquidity.

Single Outcome Binary Markets: Monaco protocol offers Single outcome binary markets which means orders can be placed either FOR the outcome () or AGAINST it (it won't happen) at a specific price (odds) and stake (wager). Binary markets also attracts high liquidity. Whereas Polymarket, prediciton market on polygon chain offers other market types such as Binary, Categorical and Scalar market types.Markets with multiple outcomes or pooled prediction mechanisms may attract lower liquidity compared to simple binary markets, especially for less widely followed events.

UX: Since monaco protocol uses Solana blockchain it provides better user expirence when compared with protocols on other blockchains such as ethereum or polygon. Solana's fast transaction confirmation times and high throughput contribute to a smoother and more seamless user experience on prediction markets. Users can interact with the platform more efficiently, placing bets, adjusting positions, and withdrawing funds without experiencing long wait times or network congestion, thereby enhancing overall satisfaction and engagement.

How can the protocol be used to drive better peer-to-peer experiences?

Monaco Protocol offers multiple features that can drive better peer-to-peer experiences:

Full Decentralized: Since applications built on Monaco Protocol are fully decentralized which means there are no central authority involved which results in reduced manipulation in betting platforms. It also allows user to have full access over there fund which increases trustworthiness in the platform and users can make transaction without having any intermediaries in between.

Transparency: Through the use of blockchian technology every transaction executed is available on the public blockchain ensuring full transparency.

Low fees: Since the Monaco Protocol is deployed on Solana Blockchain the fees for executing the transaction on the blockchain is extremely low. Lows fees highly attracts users.

UX: Since Monaco Protocol uses Solana blockchain it provides better user expirence when compared with protocols on other blockchains such as ethereum or polygon. Better UX not only attracts more users but also retains them.

Global Liquidity: Application using Monaco Protocol have access to shared liquidity. So if any operator creates a market for the superbowl, anyone can use that market. If you're another operator you don't need to make your own superbowl market, you use that one. As such liquidity isn't fragmented.

Points: This concept of collecting the points as use intract with protocol highly attracts users as now they are getting points when they interact with the protocol which means in future these points can be the key to exclusive promotions, bonuses, and rewards that the Monaco Protocol might offer.

Some Highly successfull use-cases bulit on Monaco Protocol:

BetDex: is the first application built on Monaco Protocol. The BetDex is a decentralized sports betting exchange is a peer-to-peer (P2P) marketplace that connects traders allowing them to trade their opinions on various outcomes in sports using cryptocurrency.

You can access the BetDex application from here: BetDex

You can read more about BetDex here: BetDex Documentation

Purebet: Purebet is an on-chain sports betting exchange and cross-chain sports betting odds/liquidity aggregator.

Purebet is made up of 2 parts:

the custom built on-chain sports betting exchange matching engine

the cross-chain odds/liquidity aggregator which aims to show the liquidity of every on-chain sports betting protocol in one place.

Purebet utilizes liqudity from the monaco Protocol.

You can access the Purebet application from here: PureBet

You can read more about PureBet here: Purebet Documentation

Bet on Anything: BOA is an AI powered prediction markets where users can create a market for anything they want and AI will resolve and settle the markets

- You can access the Bet On Anything application from here: betonanything.io

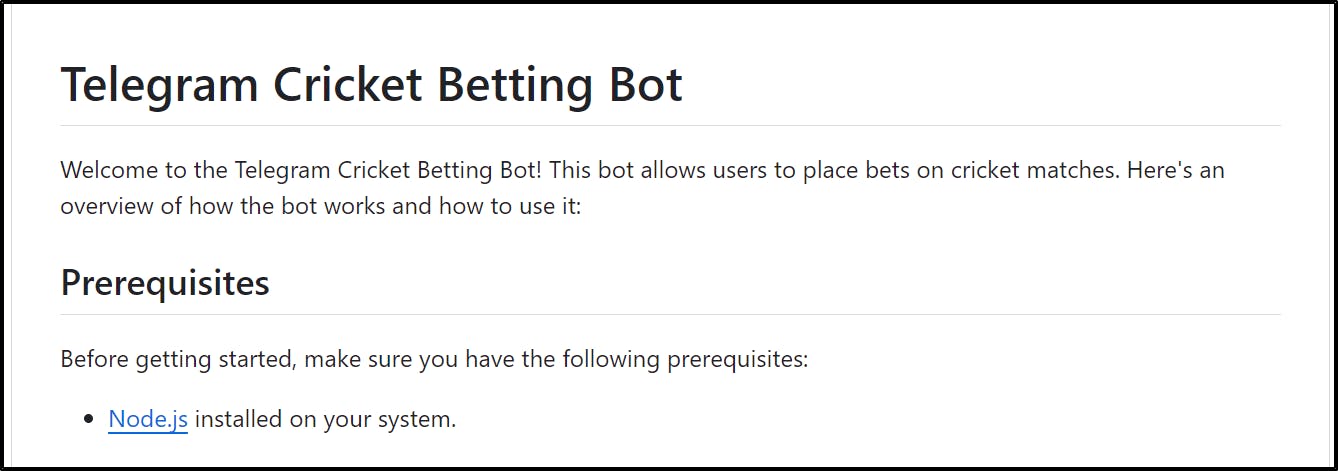

Cricket Bet Bot: This bot allows users to place bets on cricket matches.

- You can find the details for using the Telegram Bot here: Cricket Bet Bot

Disbet: DisBet is a Discord bot which enables on-chain betting on sports events using Monaco Protocol. Using simple commands and clean embeds, it makes it super easy and quick to bet on events on-chain.

You can find the details for using the Discord Bot here: disbet

You can find the demo here: Demo Video

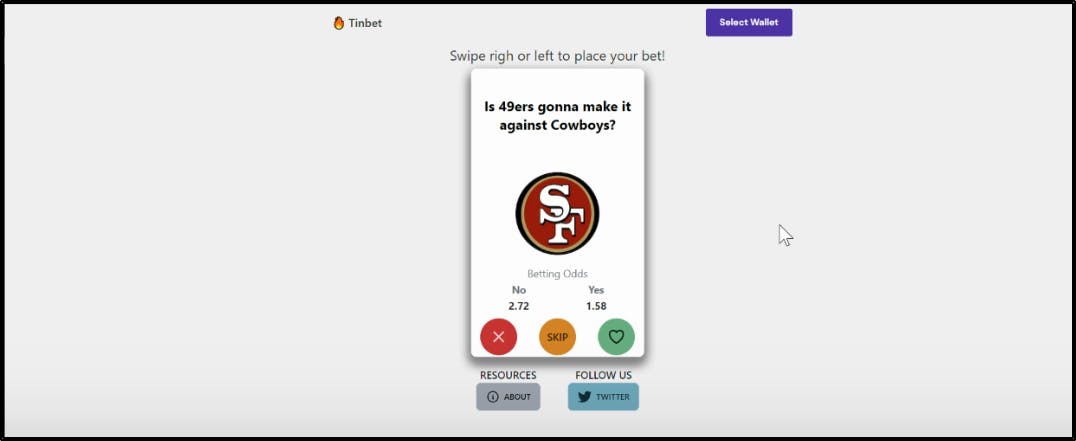

Tinbet: Tinbet is a tinder-like decentralized betting platform built on Solana. Tinbet integrates Monaco Protocol for order booking, matching and clearing and allows you to bet in some outcomes of events and markets from BetDex.

You can find the details for using the tinbet here: tinbet

You can find the demo here: Demo Video

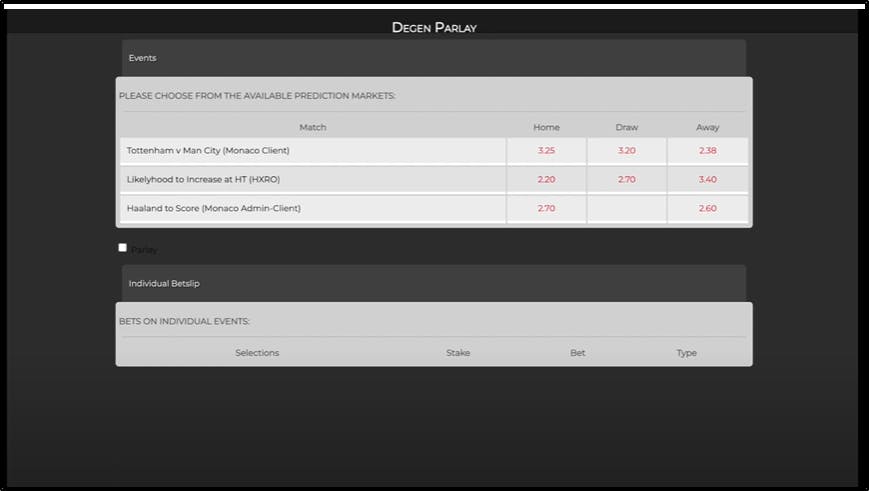

Degen Parlay: Degen Parlay is a sports betting protocol on Solana, introducing parlays to the blockchain and making the most out of Monaco Protocol and HXRO’s Parimutuel Protocol.

- You can find the demo here: Demo Video

Parier: Equity betting platform to bet on asset prices (e.g. TSLA price in the next hour).

You can find the details for using the Parier here: Parier Github

You can find the demo here: Demo Video

Story Bet: An AI based platform allowing users to bet on the outcome of a story.

Which use cases would you like to see on Monaco protocol and why?

Monaco protocol opened up a new chain of possiblites in world of prediction markets:

Analytical Tools: Creating tools that will detect or generate an alert whenever there is ‘high ROI’ wallet movements or ‘whale’ movements to its users. As these tools can help users to get insights on whale wallets such as on what prediction markets the whale wallets are mostly betting on, it can also help the user to anlyze the betting trends. By studying the betting trends of whale wallets user can gain valuable insights into market sentiment. Also tools made for detection of investments resulted in High ROIs can help users identifying betting opputunites that made High returns on a certain bet.

NFT betslips: An NFT betslip can be a unique token representing your bet details. These details can include event on which bet was made, what was the outcome, on what date or time was the bet made, etc. I would like to see this use-case on monaco protocol as it will help the users to capture there betting moments on the blockchain such as for every user there first bet is special for them, bets in which the user made fortunes, etc

NFT Predicition Markets: I would also like to see a prediction market for NFTs betting built on Monaco Protocol. In this NFTs betting can be done on specific NFTs from a collection, a certain NFT will be a criteria for airdrop or not etc. Allowing bets on specific NFTs, NFT collections, etc can attract a large user base. This could attract NFT communities, Artisits, NFT lovers, NFT holders and many more users to come and bet on the platform. This can also result in strong community bond.

Social Betting: I would also like to see an application built using Monaco Protocol which allows a group of users to place a bet. This idea can result in strong communities as instead of single user now whole groups are involved.

Conclusion:

Monaco Protocol is not just a simple protocol but a fully powered decentralized betting engine that offers global liquidity on prediction markets. Monaco protocol offers so much when it comes to building and innovation user can build social betting apps, new prediction markets, Analytics Dashboards and Tools etc. Monaco Protocol also have matched total bets more than 8 million dollars which is a remarkable achievement, this also shows that this betting market is extremely huge and has lots of potential.